1.3 The State of Biodiversity Finance

Biodiversity finance19 is the practice of raising and managing capital and using financial and economic incentives to support sustainable biodiversity management20. It is about leveraging and effectively managing economic incentives, policies, and capital to achieve the long-term well-being of nature and our society. Although financial and economic decisions and arguments are effective in preserving biodiversity, they do not capture the most important moral, ethical, and ecological aspects associated with nature. As such, economic and finance arguments should complement and not replace ethical motivations.

Biodiversity finance flows include private and public financial resources used to conserve and restore biodiversity, investments in commercial activities that produce positive biodiversity outcomes and the value of the transactions in biodiversity-related markets such as habitat banking. Data on biodiversity finance is difficult to track due to the opacity of certain transactions and the lack of commonly understood definitions.

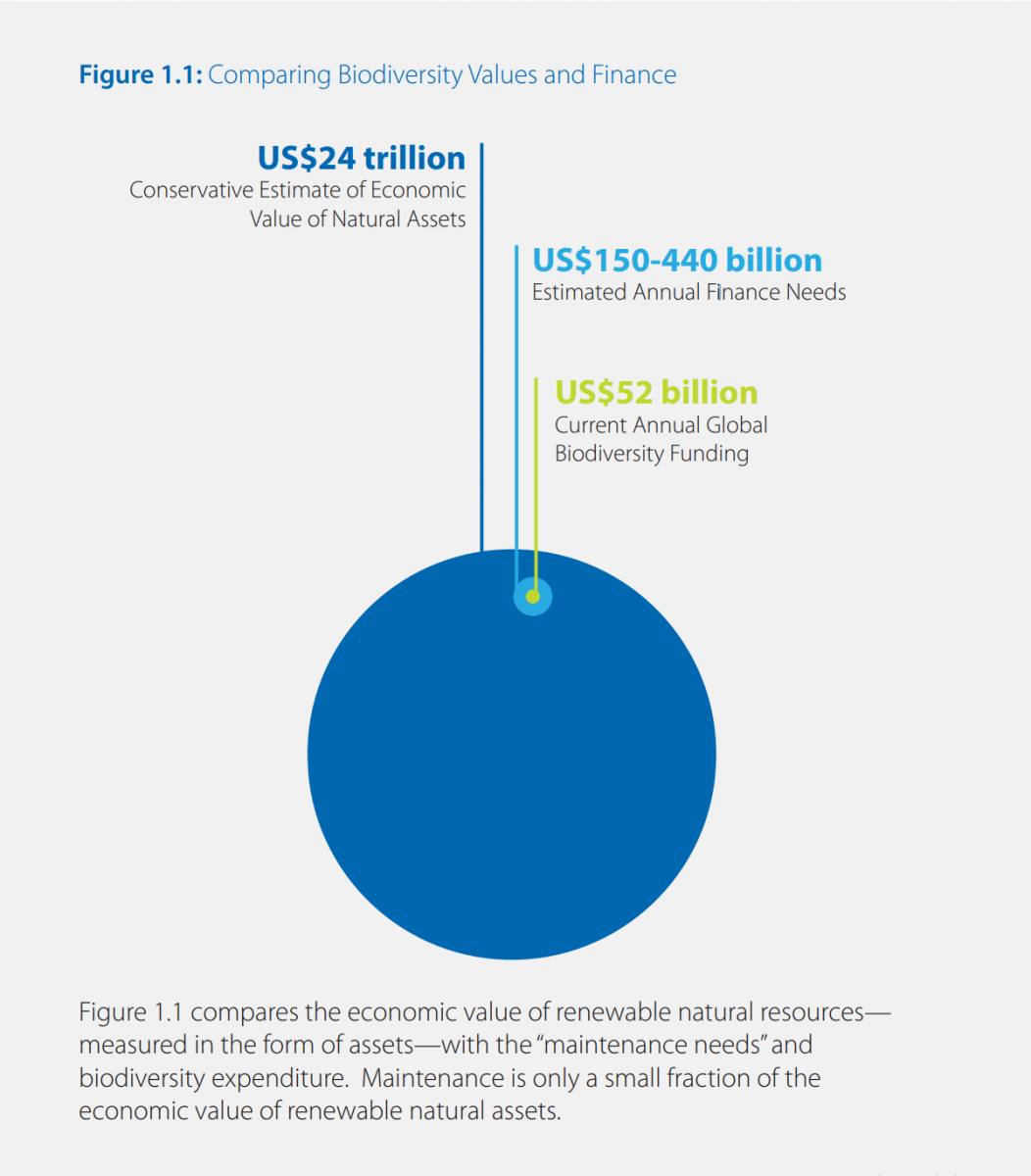

The most recent calculation estimates all expenditures towards biodiversity to be around US$52 billion per year, amounting to only a fragment of its estimated economic value.21 This equates investing US$20,000 per year on a factory that produces US$10 million a year in revenues. BIOFIN countries show that, on average, biodiversity expenditures account for between 0.03 and 0.94 percent of GDP, or between 0.14 percent and 4.60 percent of the entire public budget.

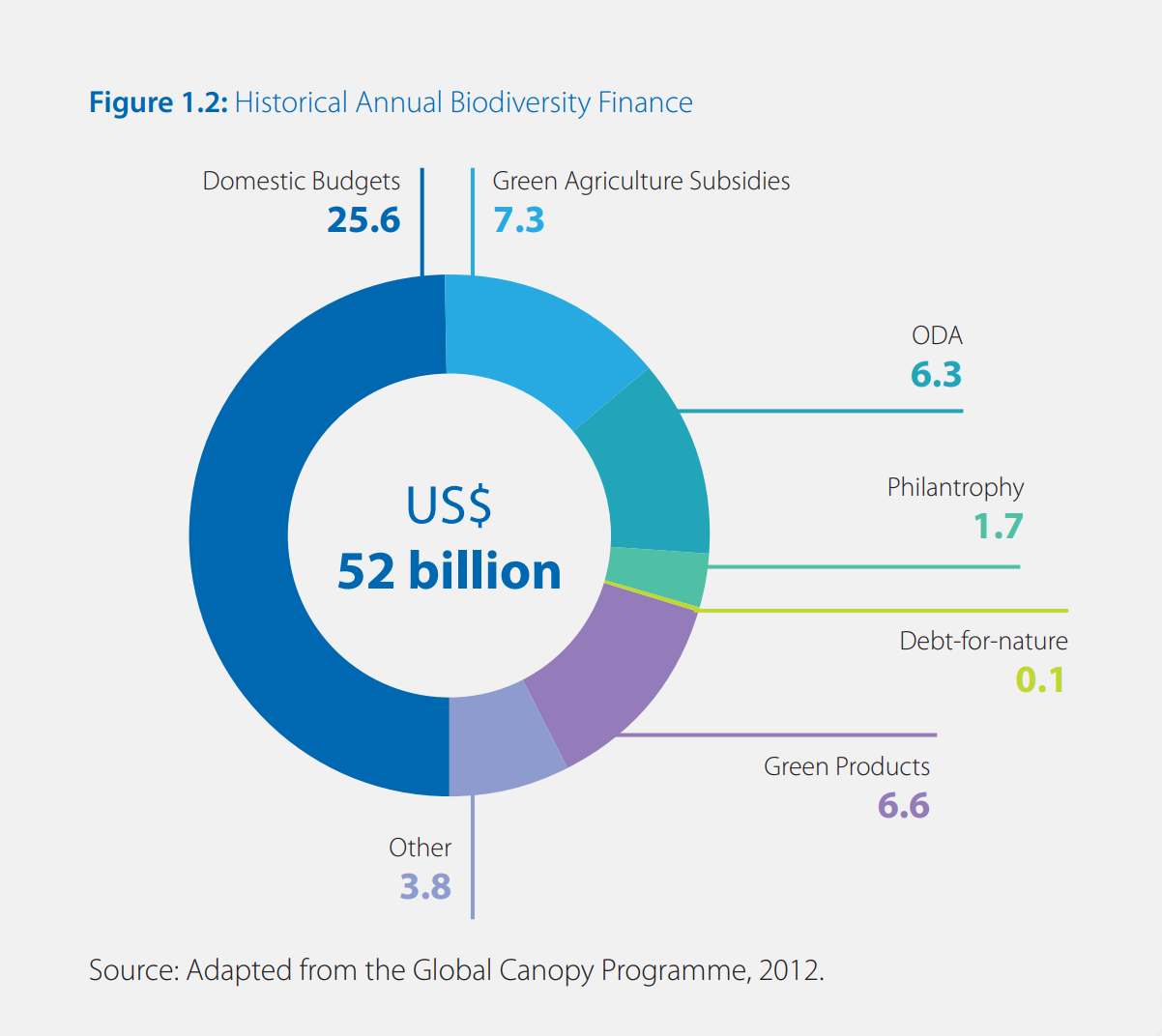

Currently, public finance is the primary source of financing, in particular domestic public budgets (50 percent), biodiversity-positive agricultural subsidies (14 percent), and Official Development Assistance (ODA, 12 percent). Conservative and partial estimates of the private sector contribution has been relatively modest, but grew exponentially in the last decade. Private capital committed to conservation grew from less than a billion in 2004-2008 to US$8.2 billion in 2015.22 Figure 1.2 demonstrates that only a small number of finance solutions are responsible for channelling the majority of funding towards biodiversity conservation objectives.

How is the above financing compared to needs? Although we have global estimates from models, neither the current level of investment in biodiversity nor needs have been systematically articulated on a national scale. A global assessment estimated the resources required to implement the CBD Strategic Plan for Biodiversity (2011-2020) at US$150-440 billion per year.23 Parker and others provide a similar estimate in the range of US$300-400 billion per year.24 On that basis, Credit Suisse and others pointed to the fact that biodiversity finance needs to grow 20-30 times greater than it is today, if this gap is to be closed.25 While the task might seem insurmountable, it is important to emphasize that the top bracket of the estimated biodiversity finance gap is still only about .05 percent of global GDP.

The scope for increasing financing from traditional sources— central government budgeting, donor funds, royalties and other charges—remains limited. Fierce competition for scarce public resources persists as global challenges from the energy transition to end poverty abound everywhere. Despite challenges, there is scope for optimism. Tax revenues as a percentage of GDP are forecast to increase slightly in many developing countries.26 We can allocate these additional revenues to sustainable development, including the protection of biodiversity. Much larger opportunities exist to reform and redirect existing financial flows, such as subsidies that work against the very objectives of sustainable management. Potentially harmful subsidies to the environment are estimated at 9 times the total biodiversity expenditures and 75 times ODA levels spent on biodiversity.27 Similarly the New York Declaration on Forests found that positive financing for activities such as REDD+ is dwarfed by “subsidies and investments in sectors driving deforestation (e.g., agriculture), amounting to 40 times the investments to protect”.28

Lacking information on recipient country expenditures and needs, development partners have been reluctant to substantially expand their financial support to biodiversity. Only around US$8.7 billion flowed from developed to developing economies in 2014-2015.29 There is a strong case for increasing funding flows from developed countries.30 Increased donor funding can in turn leverage and incentivize private sector investment. The Global Environmental Facility (GEF), the largest multilateral funder of biodiversity, has invested more than US$3.5 billion.31

Beyond biodiversity, the 2030 Agenda requires unprecedented investments in areas such as health and education, environmental protection, infrastructure and energy, and peace and security. The additional investment faces a gap of US$1.9-3.1 trillion per year in developing countries alone.32 Investments required in telecommunications and transport, power and climate change mitigation require even more financing than biodiversity, often competing for the same scarce public resources.

This is not due to a structural lack of available finance. The world has never been as rich as it is today. The total stock of global financial assets is valued at over US$200 trillion. Closing the gap is theoretically possible. There is similarly no shortage of liquidity in the world. The problem is the current direction and scale of investment flows. This is about more than the public finance needed. It is also about how to better align private capital with the SDGs.33 The financing for development process and debate consider ways to finance the implementation of the ambitious 2030 Agenda.34 The Addis Ababa Action Agenda provides a guide and vision for financing the SDGs.35 Making a strong case for investing in biodiversity as a driver for sustainable development is the logical, correct thing to do, and it can also potentially capture increased financing.

The poaching of elephants, rhinos, and other endangered wildlife species is a case in point. The price received for killing an elephant for ivory by criminal syndicates represents a tiny share of its economic value to a country, which, in the case of Kenya, has been estimated at US$1.6 million in tourism value over the elephant’s lifetime.36 Preserving biodiversity means preserving the economic assets of developing countries, while expanding opportunities for communities to share in the financial returns of tourism and enjoy sustainable livelihoods.

The term is like the more commonly used “Conservation Finance” but avoids the connotation of a focus on “conservation” as the primary or only objective.

Clark, S. (2012). A field guide to conservation finance. Island Press.

The available funding for biodiversity is estimated at approximately US$ 52 billion per year. Parker, C., Cranford, M., Oakes, N., & Leggett, M. (2012). The little biodiversity finance book. Global Canopy Programme, Oxford. Available from: http://globalcanopy.org/sites/default/files/documents/resources/LittleBiodiversityFinanceBook_3rd%20edition.pdf

Hamrick, K. (2016). State of Private Investment in Conservation 2016: A Landscape Assessment of an Emerging Market. Forest Trends’ Ecosystem Marketplace. Available from: https://www.forest-trends.org/wp-content/uploads/2017/03/2016SOPICReport_FINAL_Full-REV.pdf

Convention on Biological Diversity (CBD) (2012). Resourcing The Aichi Biodiversity Targets: A First Assessment Of The Resources Required For Implementing The Strategic Plan For Biodiversity 2011-2020. Available from: https://www.cbd.int/doc/meetings/fin/hlpgar-sp-01/official/hlpgar-sp01-01-report-en.pdf

Parker, C., Cranford, M., Oakes, N., & Leggett, M. (2012). The little biodiversity finance book. Global Canopy Programme, Oxford. Available from: http://globalcanopy.org/sites/default/files/documents/resources/LittleBiodiversityFinanceBook_3rd%20edition.pdf

Credit Suisse, WWF and McKinsey (2014). Conservation Finance: Moving beyond donor funding toward an investor-driven approach. Available from https://www.cbd.int/%20financial/privatesector/g-private-wwf.pdf

The World Bank (2016). See: https://data.worldbank.org/indicator/GC.TAX.TOTL.GD.ZS

Based on comparison of annual biodiversity expenditures (identified above) to global agricultural and other subsidies, quantified at over US$ 450 billion/yr during the 2000s (see Chapter 4).

New York Declaration on Forests website accessed September 15, 2018. Available from: http://forestdeclaration.org/goal/goal-8/

OECD (2016). Biodiversity-related official development assistance 2015. Available from: http://www.oecd.org/dac/environment-development/Biodiversity-related-ODA.pdf

See Figure 1.2.

The GEF. See: https://www.thegef.org/topics/biodiversity Accessed September 2018

United Nations (2015). Addis Ababa Action Agenda of the third international conference on financing for development. United Nations. Available from: http://www.un.org/esa/ffd/wp-content/uploads/2015/08/AAAA_Outcome.pdf

The Global Impact Investing Network (GIIN, 2018). Financing the Sustainable Development Goals: Impact Investing in action. Available from: https://thegiin.org/research/publication/financing-sdgs

Food and Agriculture Organization (FAO) (2015). Global Forest Resources Assessment 2015. Available from: http://www.fao.org/3/a-i4793e.pdf

In 2015 the United Nations announced new 17 Sustainable Development Goals with 169 associated targets which are integrated and indivisible. The targets will guide the decisions taken over the next 15 years. See https://sustainabledevelopment.un.org/content/documents/21252030%20Agenda%20for%20Sustainable%20Development%20web.pdf