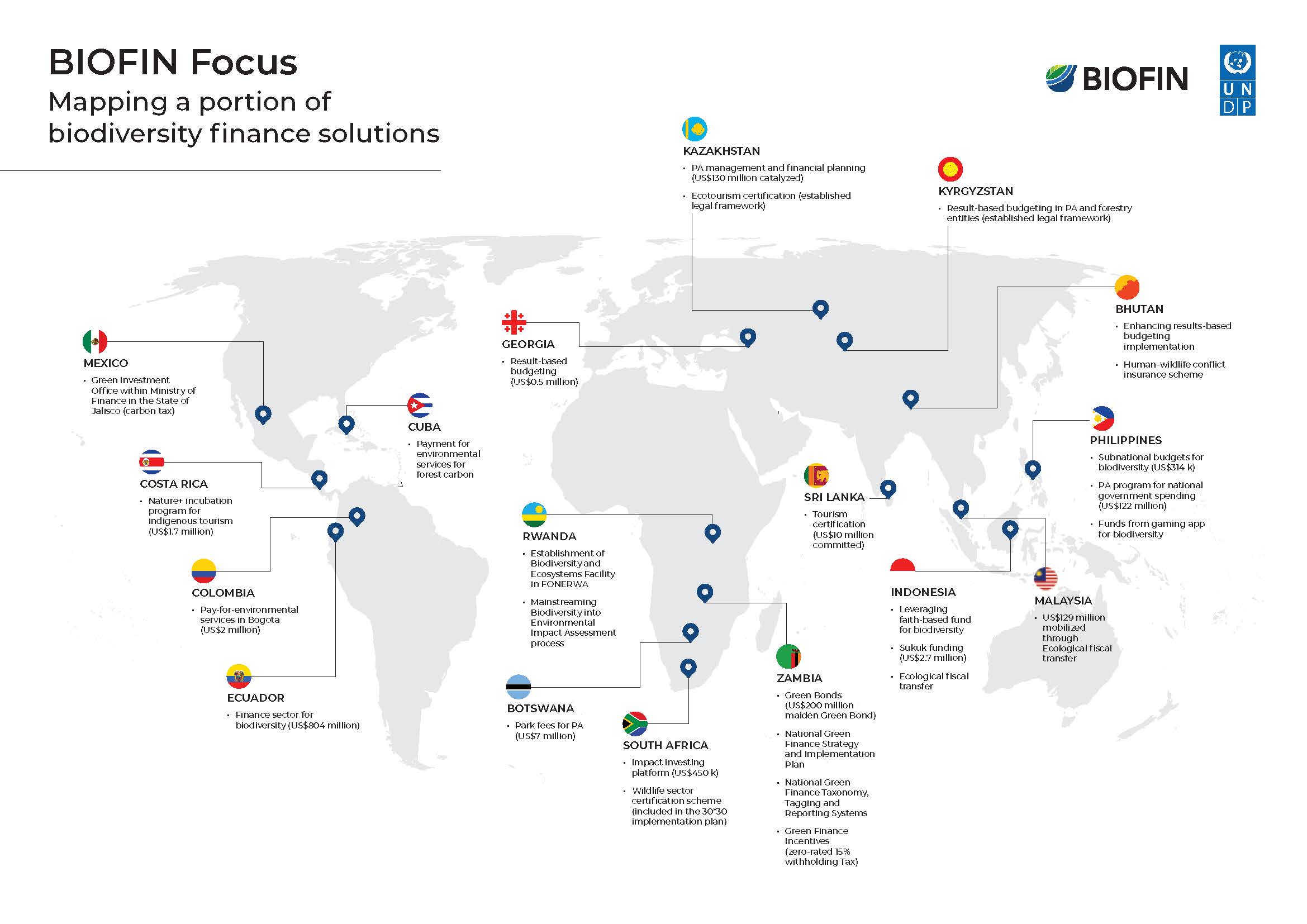

Through innovative financial solutions tailored to national needs, the Biodiversity Finance Initiative (BIOFIN) has helped countries catalyze over US$1.6 billion to protect nature, build resilient communities, and realign economies toward a nature-positive future.

From green bonds to digital crowdfunding platforms, BIOFIN is showing how finance and conservation can work together. Below are some of the financial tools transforming biodiversity protection - and the countries putting them to work.

Protected area fees, derived from visitor entrance charges, are reinvested into the maintenance and enhancement of conservation areas. This approach not only boosts the financial sustainability of protected areas but also improves visitor infrastructure and supports community development. Costa Rica stands out with its innovative SINAC Future Flows Securitization Bill. By securitizing future revenue from protected area entrance fees, Costa Rica can issue green or sustainable bonds, raising immediate capital for conservation without adding to public debt. This model ensures that its 166 protected areas receive critical investments for infrastructure and community development, serving as a model for other countries seeking to bridge the biodiversity finance gap. The innovation has already attracted $5.58 million for protected area infrastructure, contributing to a total of $95.39 million mobilized for nature-positive investments in the country with BIOFIN support. Similarly, Botswana revised its fee structures for protected areas, which resulted in an additional $7 million in funds. These new revenues are being reinvested into park infrastructure, conservation management, and community development initiatives. Meanwhile, the Philippines has increased protected area budgets by $122.3 million in the past few years. This surge in investment followed the enactment of key policy reforms, including the Expanded National Integrated Protected Areas System (E-NIPAS) Act, demonstrating the power of legislative support in mobilizing sustainable finance for conservation. In Kazakhstan, an improvement of protected area financing led to a cumulative budget increase of $130 million between 2020 and 2024. By aligning management plans with national conservation goals and updating policy frameworks, Kazakhstan has strengthened its ability to protect critical ecosystems at scale.

Green bonds are specifically designed to attract investments for environmentally friendly projects. They mobilize capital by tapping into global capital markets, allowing countries to finance renewable energy, conservation projects, and sustainable infrastructure while delivering measurable environmental outcomes. Zambia has taken a pioneering step by facilitating its first green bond issuance through the Copperbelt Energy Corporation Renewables. In December 2023, this issuance raised $53.5 million as part of a broader $200 million program. In December 2024, an additional issuance of $96.7 million further underscored the nation’s commitment to sustainable investments.

Payment for Ecosystem Services (PES) schemes create a direct financial incentive for maintaining healthy ecosystems. By compensating landowners and communities for the ecosystem services they provide, such as clean water, carbon sequestration, and biodiversity conservation, PES mechanisms help secure long-term environmental benefits and economic stability. In Sri Lanka, a pilot PES scheme under the Vidul Lanka hydropower project is managing 507 hectares of upper catchment lands, linking funding directly to improved ecosystem outcomes. In Cuba, the nation’s first PES program based on carbon removal reported a payment of $64,202 for sequestering 169,891.10 tons of carbon, demonstrating the tangible impact of these financial incentives.

By adjusting public spending through results-based budgeting and repurposing harmful subsidies, governments can incentivize conservation and ensure that financial flows align with environmental goals. This approach improves budget efficiency and creates measurable conservation impacts. In Telangana (India), advocacy and capacity-building efforts led to a sevenfold increase in the budget for the Telangana State Biodiversity Board - from $149,724 in 2023 to $1,2 million in 2024 - empowering local conservation actions. In Thailand, the removal of harmful subsidies for coastal infrastructure, such as those for sea walls and jetties, has allowed natural coastal processes to recover. The dismantling of these infrastructure elements has led to the restoration of native vegetation and dune formation, enhancing coastal resilience and biodiversity. For example, funds of $300,000 were allocated for the removal of detrimental coastal structures. Guatemala institutionalized environmental budget tracking at the municipal level, mobilizing US$2.5 million for biodiversity conservation. Indonesia demonstrated how national-level reforms can drive impact by expanding its biodiversity budget tracking to cover 20 ministries, overseeing a total of US$1.71 billion annually. By embedding biodiversity priorities into mainstream public budgets, Indonesia is laying the groundwork for long-term, systemic support for environmental sustainability.

Digital finance is revolutionizing how conservation projects are financed. Fintech solutions, including mobile wallet partnerships, gaming applications, and NFT-driven fundraising, are democratizing access to capital and engaging new investor communities. The Philippines is at the forefront of digital innovation in biodiversity finance. Through partnerships with mobile wallet providers like GCash, BIOFIN has supported initiatives such as “GForest,” a gamified platform that incentivizes forest restoration. The “Animal Town” mobile gaming app has attracted almost 20,000 gamers since its launch in 2024 and started generating funds for conservation. Additionally, an NFT campaign titled “Art for Nature” has raised US$5,368 to date.

BIOFIN’s integrated strategy shows how diverse financial solutions can be tailored to the unique needs of different regions and deliver tangible results.

Categories

Archives

- March 2025 (8)

- February 2025 (2)

- January 2025 (5)

- December 2024 (4)

- November 2024 (5)

- October 2024 (14)

- September 2024 (6)

- August 2024 (9)

- July 2024 (7)

- June 2024 (3)